Firstly, when the entity has a present obligation to make the payment as a result of past event and.

Profit-sharing and bonus plansĮntities recognise the expected costs for profit-sharing and bonus plans when and only when: This is solely from the fact that the benefit accumulates. IAS 19 requires entities to measure the expected cost of accumulating paid absences as the additional amount that the entity expects to pay as a result of the unused entitlement that has accumulated at the end of the reporting period. Accordingly, an entity recognises such obligation as employees render service that increases their entitlement to future paid absences.

For this, the recognition depends whether the paid absences are accumulating paid absences.Īn obligation exists for accumulating paid absence. IAS 19 provides the requirements on when should entities measure the expected cost for paid absences. As an expense in profit or loss unless another IFRSs allows or requires inclusion of the amount in the cost of an asset.Entities recognise an asset to the extent it leads to a reduction in future payments or a cash refund. However, if the amount paid exceeds the amount of benefits, entities recognise the excess as an asset. as accrued expenses, net of any amount already paid. In particular, entities recognise the amount: undiscounted amount of employee benefits). The amount recognised do not need to be discounted for time-value of money (i.e. The general principles for all short-term employee benefitsĮntities recognise the amount of benefits expected to be paid in exchange for the services rendered by employees during an accounting period. Short-term employee benefits are common to most entities.

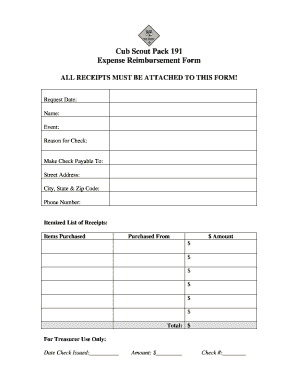

Reimbursements staff bookkeeping due to due from free#

non-monetary benefits for current employees such as medical care, housing, cars and free or subsidised goods or services.wages, salaries and social security contributions.Accounting for short-term employee benefits To further clarify, employee benefits include benefits provided and may be settled by payments made either to the employees or their dependents or beneficiaries. This is the benefits provided in exchange for the termination of an employee’s employment. For example, long-term disability benefits, long-term paid absences. Third, other long-term employee benefits.Post employment benefits are benefits payable after completion of employment. Second, post employment benefits such as retirement benefits.If an entity expect to settle the benefits wholly before 12 months after the end of the annual reporting period, the entity classfies them as short-term benefits. For this, there are four types of employee benefits: What are employee benefits?Įmployee benefits refer to all form of consideration given by an entity in exchange for service rendered by employees. Let’s now go into the details on how entities account for employee benefits.

0 kommentar(er)

0 kommentar(er)